Invest in Dubai Off-Plan With a Clear Strategy

We help you choose the right projects, understand payment plans and manage risk-so you're not just buying a brochure and a promise.

We work with multiple developers, not just one. No pressure, no spam.

Why Off-Plan Buyers Work With RE/MAX HUB

Multiple Developers

We work across projects from Emaar, Sobha, Damac, Binghatti, Beyond and more.

Data & Due Diligence

We review masterplans, payment plans and historical track records before recommending anything.

End-to-End Support

From early launch allocations to handover and leasing/resale strategy.

How We Help You Choose the Right Off-Plan Project

A structured process that balances opportunity and risk.

Strategy & Budget

Clarify your goal (home vs investment), risk tolerance, budget and time horizon.

Project & Developer Selection

We shortlist projects and developers that match your profile, showing pros/cons-not just launch hype.

Payment Plan & Contract Review

We explain the payment schedule, escrow, DLD registration and key contract points in plain English.

Construction Updates & Exit Plan

We stay involved through construction, handover and help you plan leasing or exit when the time is right.

Is Off-Plan Actually Right for You?

Off-Plan may be a good fit if:

- You have a 2–7 year horizon and don't need to move in immediately.

- You want payment plans or lower entry price vs ready property.

- You're comfortable with some construction and timeline risk.

- You care about new communities, amenities and facilities.

Off-Plan is probably not for you if:

- You need to move in within the next 6–12 months.

- You're depending on immediate rental income.

- You can't tolerate construction delays or design changes.

- You're chasing "quick flip" rumors more than fundamentals.

Featured Off-Plan Projects We Currently Recommend

Handpicked based on developer track record, location and payment terms.

Creek Beach Residences

Dubai Creek Harbour

- 60/40 post-handover payment plan

- Handover Q4 2027

- Waterfront + community amenities

Sobha Seahaven

Dubai Harbour

- 70/30 payment plan

- Handover Q2 2028

- Beach access + luxury finishes

Burj Binghatti Jacob & Co

Business Bay

- 80/20 payment plan

- Handover Q1 2027

- Iconic design + prime location

Developers We Work With (and Why)

We don't push a single developer's stock. We work across multiple UAE developers and give you a view on track record, delivery, and after-sales.

Emaar

Large master-planned communities and strong brand recognition.

Sobha

High-spec finishes and integrated communities.

Damac

Diverse portfolio across Dubai with varied price points.

Binghatti

Distinctive designs and active pipeline across Dubai.

Beyond

Focused developer with niche projects.

Mira

Family-oriented communities with strong amenities.

Object One

Boutique developments with unique positioning.

Peace Homes

Value-focused projects in emerging areas.

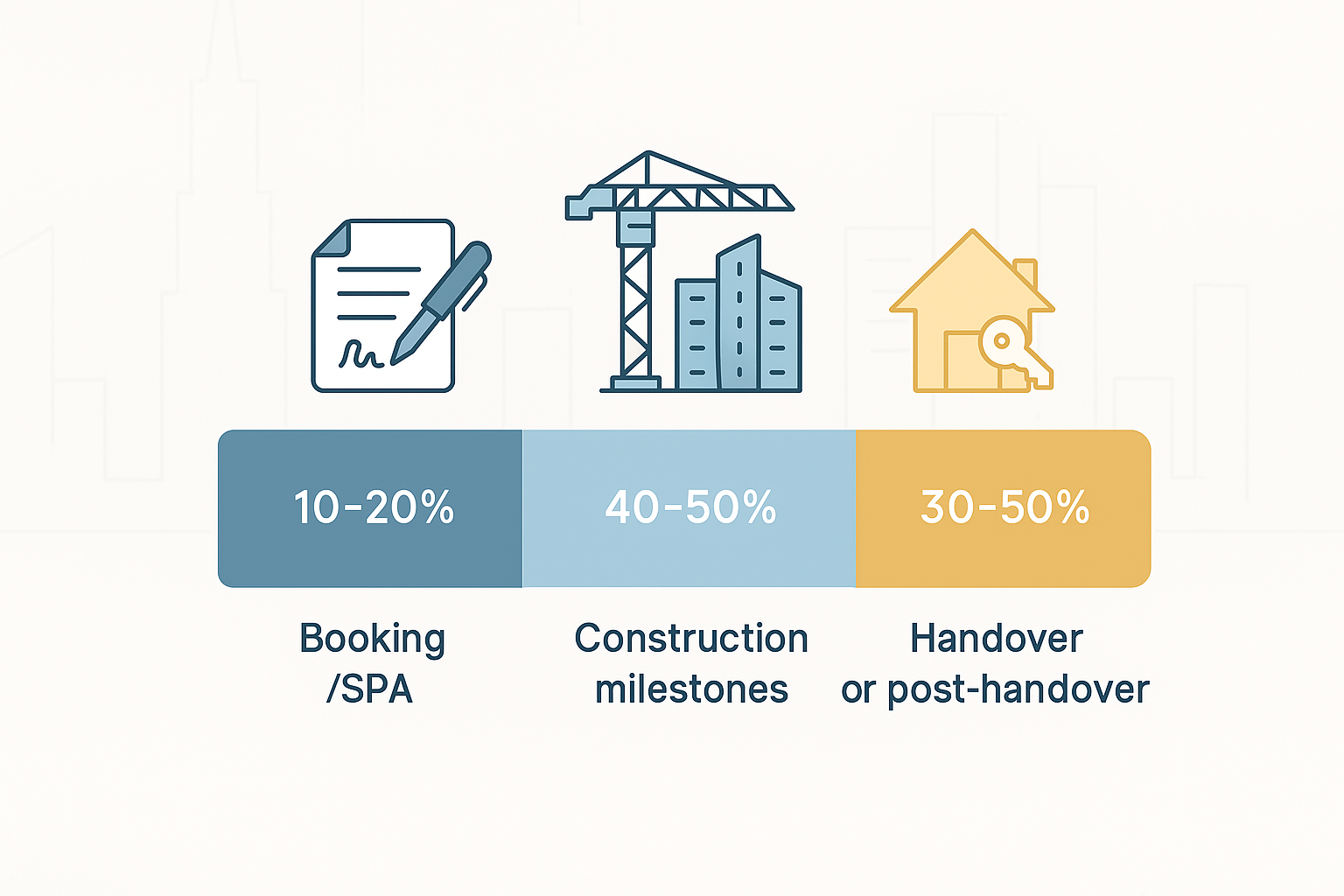

How Off-Plan Payment Plans Actually Work

Understand the cashflow before you sign anything.

Most off-plan purchases start with a booking fee and signing the SPA (sale and purchase agreement). After that, your payments are usually tied to construction milestones – for example, a percentage at foundation, structure, and completion of key stages.

A larger chunk is due at handover when you receive the keys, and some projects offer post-handover payment plans, where the final portion is paid over 1–5 years after you move in or start renting the unit.

The key is to map this schedule against your actual cashflow and financing, not just the developer's marketing slide.

Want us to stress-test a payment plan against your cashflow?

Off-Plan vs Ready – The Real Trade-Offs

Ready Property

Pros:

- Immediate move-in or rental income

- What you see is what you get

- Easier mortgage approval

- No construction risk

Cons:

- ✕Higher upfront cost

- ✕Less payment flexibility

- ✕May need maintenance/upgrades

Off-Plan

Pros:

- Lower entry price (10-30% cheaper)

- Flexible payment plans (2-5 years)

- Brand new with warranty

- Potential capital appreciation

Cons:

- ✕2-4 year wait until handover

- ✕Construction/delivery risk

- ✕Market price uncertainty

- ✕Less liquidity during construction

Not sure which route makes more sense for you right now?

See Where Dubai Is Heading, Not Just What's Launching

Our 2026–2035 Playbook outlines our expectations for key corridors, asset types and off-plan cycles.

- Demand trends by area and asset type.

- Where off-plan stock is concentrated.

- Our view on risk, timelines and pricing cycles.

How We Help You Manage Off-Plan Risk

- We look at developer track record (delays, handover quality, service charges).

- We check escrow, RERA registration and project status before you commit.

- We highlight contract clauses that you should pay attention to (delays, variations, cancellation).

- We help plan exit scenarios (hold, rent, sell around handover).

Disclaimer: We are not a law firm or financial advisor, but we help you ask the right questions before you sign.

What Our Off-Plan Buyers Say

Off-Plan FAQs for Dubai Property

Still unsure whether a specific project is worth it? Ask us to review it with you.

Ready to Build an Off-Plan Plan?

Tell us what you're considering and we'll come back with a structured view—projects we like, ones we'd avoid, and what fits your budget.

Prefer WhatsApp? Message us at +971 50 210 4130 with "Off-plan enquiry" and the projects you're looking at.